Private Equity: Transforming Established Businesses

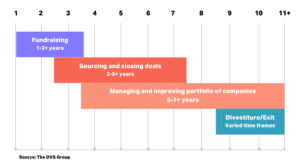

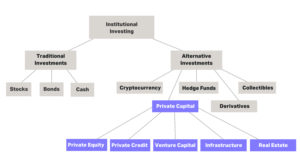

Private equity represents one of the most established segments of private capital, focusing on acquiring mature companies with proven business models and cash flows. Private equity firms typically purchase controlling stakes in these businesses, implementing strategic and operational improvements to enhance value over a three to seven-year investment period. This approach allows private equity managers to work directly with management teams to optimize operations, expand market reach, and improve financial performance.

The private equity investment process involves rigorous due diligence, comprehensive business analysis, and detailed value creation planning. Successful private equity investments often result from identifying companies with strong fundamentals but unrealized potential, whether through operational inefficiencies, limited market penetration, or suboptimal capital structures. By providing both capital and expertise, private equity firms help transform these businesses into more competitive and valuable enterprises.

For investors, private equity offers exposure to a diverse range of industries and business models while benefiting from professional management and active value creation. The illiquid nature of private equity investments is offset by the potential for superior returns compared to public market alternatives, making it an essential component of sophisticated investment portfolios seeking long-term wealth accumulation.